WE DO IT SMART

KLOSED PROPERTIES IS A FAMILY OWNED, VERTICALLY INTEGRATED REAL ESTATE FIRM.

Klosed Properties is a commercial real estate company focused on the acquisition and repositioning of well located assets. We are a real estate firm specialized in the acquisition and management of well positioned commercial properties in the New York Metro as well as in select markets nationwide.

LEARN MOREOUR NUMBERS

We focus on underperforming assets and opportunistic investments. By utilizing our strong analytical skills, deep knowledge of the market, creative deal structures and critical relationships within the industry, we are able to unlock the value and potential of underperforming assets.

Assets Under Management

With over 90 assets under our management, Klosed Properties is growing and expanding its portfolio at an unprecedented pace. We target densely populated markets and commercial corridors and shopping centers where retailers register high sales volume.

In Transaction Volume

Klosed Properties has been growing at an unprecedented pace primarily due to its stellar reputation and integrity within the industry. As a family firm, we apply our core values in every aspect of our lives - especially in business

Successful Transactions

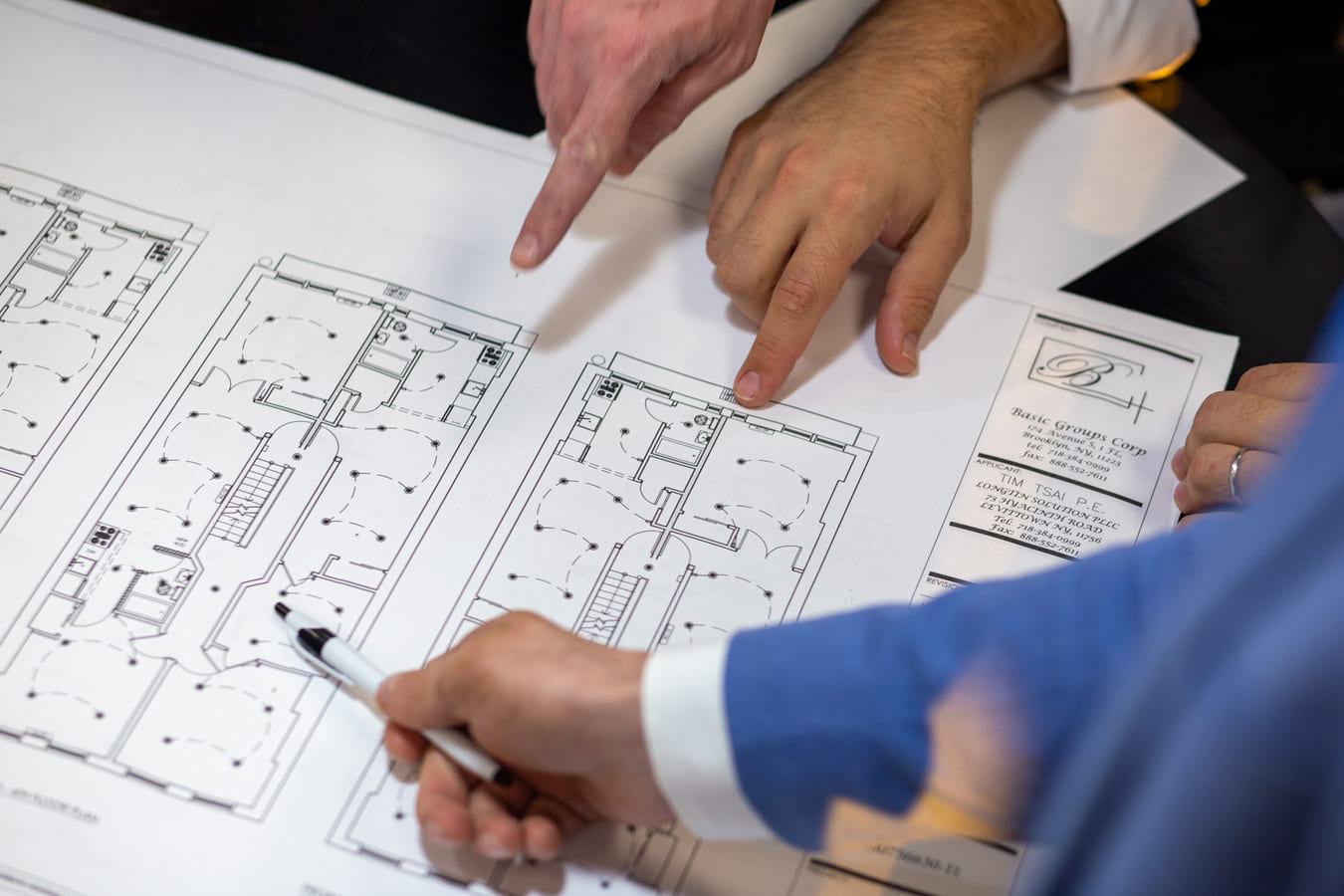

Our vertically integrated business spans across sourcing, funding, renovating and managing our assets internally gives us a solid competitive edge.

Completed Projects

Klosed Properties cuts out the middlemen which simplifies and accelerates our decision-making processes and boosts performance.

Gross Revenue

We have developed a proprietary nationwide platform that allows us to analyze each segment of every major retail market in the U.S. in granular detail. We close up to 15 deals a year and have invested more than $265,000,000 since 2008.

Assets Under Management

In Transaction Volume

Successful Transactions

Completed Projects

Gross Revenue

OUR CORE INTERESTS

Retail - New York Metro

Mixed Use Buildings

Multifamily

With over 90 assets under our management, Klosed Properties is growing and expanding its portfolio at an unprecedented pace. We target densely populated markets and commercial corridors and shopping centers where retailers register high sales volume.

With over 90 assets under our management, Klosed Properties is growing and expanding its portfolio at an unprecedented pace. We target densely populated markets and commercial corridors and shopping centers where retailers register high sales volume.

With over 90 assets under our management, Klosed Properties is growing and expanding its portfolio at an unprecedented pace. We target densely populated markets and commercial corridors and shopping centers where retailers register high sales volume.

With broad expertise in investing, structuring, design, development and asset management, Klosed professionals oversee projects in residential, industrial, office and hospitality from concept to completion.